20 Jul 2023 Beware of IRS Phishing Email Scams

It’s important to stay vigilant this summer as there have been reports of tax scams circulating. Scammers are using email and text messages to trick people into believing they are entitled to tax refunds or in need of help fixing their tax issues. Be cautious of any unsolicited messages and double-check with official sources before providing any personal information. Remember that the IRS never contacts taxpayers through email, text messages, or social media to request personal or financial information, including PIN numbers, passwords, or access information for credit cards, banks, or financial accounts.

Phishing is a deceptive scam often conducted through unsolicited emails and websites, masquerading as genuine sources to deceive unsuspecting individuals into sharing personal and financial details.

How to Identify a Phishing Email

- Sender’s email address: Check if the email is sent from a public domain email address rather than an official IRS domain.

- Suspicious attachments: Exercise caution when dealing with emails containing unexpected attachments, as they may contain malware.

- Urgency: Phishing emails often create a sense of urgency to prompt immediate action, urging you to overlook inconsistencies.

- Spelling or grammatical errors: Phishing emails may exhibit language errors, indicating they are likely not from a native speaker.

If You Receive a Suspicious IRS-Related Email

- Do not reply to the email.

- Avoid opening any attachments, as they may contain malicious code.

- Refrain from clicking on any links. “The IRS is seeing a wave of these summer scams relentlessly pounding taxpayers,” said IRS Commissioner Danny Werfel. “People are being flooded with these email and text messages, but we want them to avoid getting swept up in these terrible scams. Taxpayers should be wary; remember, don’t click on links from questionable sources.” If you have already entered confidential information, visit the IRS identity protection page.

- Forward the email as-is to phishing@irs.gov, preferably with the full email headers, but do not forward scanned images as they may remove crucial information.

- Delete the original email immediately.

For more information, you can visit IRS.gov.

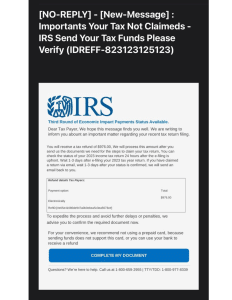

Disclosure: the image below is merely an example, and there may be other variations to be cautious of. If you ever receive a suspicious IRS email, please follow the steps above.

Contact Us

DO YOU HAVE QUESTIONS OR WANT TO TALK?

Fill out the form below and we’ll contact you to discuss your specific situation.