06 Jan 2021 Extension of COVID-19 Employee Retention Credits

Posted at 19:02h

in Uncategorized

This may be one of the most important sections of the December 2020 Tax Act for Businesses. It may provide significant tax credits on Forms 941 and 944.

Original Employee Retention Credit (ERC) – CARES Act Legislation March 2020

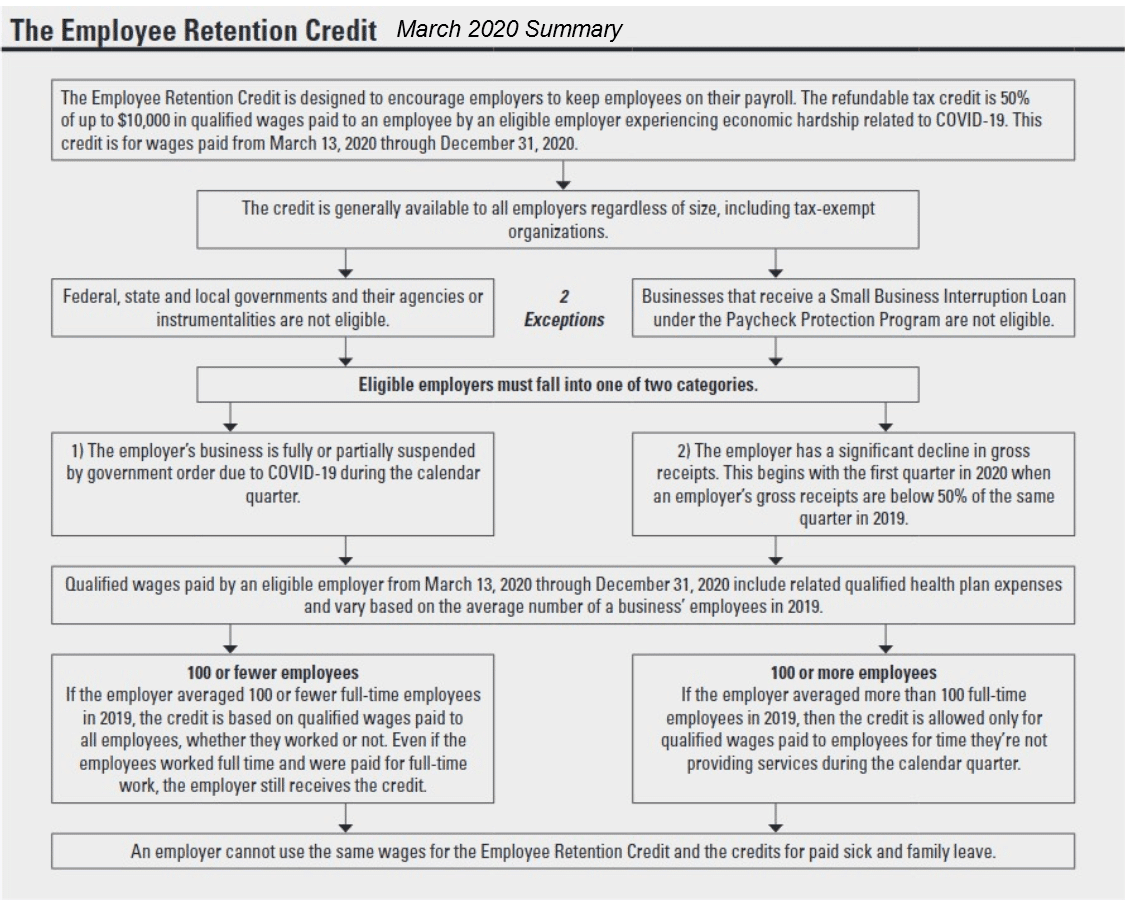

- For qualified wages paid after March 12, 2020, and before January 1, 2021, employers are allowed a refundable tax credit equal to 50% of qualified wages, including allocable qualified health plan expenses. The credit is designed to encourage employers to retain their workers when their business operations slow down or are temporarily suspended due to COVID-19.

- Employers claim these credits on Forms 941, & 944, and are calculated on Worksheet 1.

- The chart below is a summary of the March 2020 Pandemic Relief. Further in this article we will highlight the December 2020 changes.

The Employee Retention Credit – March 2020 Summary (see below for December 2020 Changes)

Paid sick days and vacation days.

- An employer that averaged more than 100 full-time employees in 2019 may not treat as qualified wages amounts paid to employees for paid time off for vacations, holidays, sick days, and other days off.

- These wages are paid pursuant to existing leave policies that represent benefits accrued during a prior period in which the employees provided services.

- However, if the eligible employer averaged 100 or fewer full-time employees in 2019, all wages paid to employees, including paid sick leave and paid vacation days, are qualified wages.

- However, note that such wages, if paid under the FFCRA for paid sick leave and paid family leave, are not qualified wages for purposes of the Employee Retention Credit.

December 2020 Consolidated Appropriations Act – Employee Retention Credit (ERC) modifications:

- The bill extends the CARES Act Employee Retention Credit (ERC) through June 30, 2021.

- It also expands the ERC and contains technical corrections.

- The expansions of the credit include:

- An increase in the credit rate from 50% to 70% of qualified wages for 2021

- An increase in the limit on per employee creditable wages from $10,000 for the year to

$10,000 for each quarter - A reduction in the required year-over-year gross receipts decline from 50% to 20%

- A safe harbor allowing employers to use prior-quarter gross receipts to determine eligibility

- A provision to allow certain governmental employers to claim the credit

- An increase from 100 to 500 in the number of employees counted when determining the relevant qualified wage base

- Rules allowing new employers who were not in existence for all or part of 2019 to be able to claim the credit

- The bill also (retroactive to the effective date of the CARES Act):

- Provides that employers who receive PPP loans may still qualify for the ERC with respect to wages that are not paid with forgiven PPP proceeds.

- Clarifies the determination of gross receipts for certain tax-exempt organizations.

- Clarifies that group health plan expenses can be considered qualified wages even when no other wages are paid to the employee, consistent with IRS guidance.

- For more details read the Forbes article by Tony Nitti Breaking Down Changes to the Employee Retention Tax Credit in the New Covid Relief

- Section 206 of the law changed who may claim the ERC – but not the computational rules – for the period March 12, 2020, through December 31, 2020.

- Section 207 of the Act extends the ERC, which was originally slated to expire at the end of 2020, until July 1, 2021, More importantly, however, Section 207 dramatically changes the computational rules for the final six months of the program.

- For the first time, a business who borrowed a PPP loan may claim the ERC for 2020.

- All who borrowed a PPP loan can now go back and claim the ERC for 2020.

- Congress will let us have BOTH the PPP and ERC for 2020, but not on the same dollars of payroll

- Section 206(c) established an important ordering rule:

- Any payroll costs – W-2 wages or health care costs – for which a taxpayer claims an ERC (or a new disaster ERC as allowed by the latest bill) are NOT eligible to be forgiven as part of the PPP process.

- Thus, while a taxpayer may BOTH claim the ERC and borrow a PPP loan, they cannot do it on the SAME wages or health care costs, and the priority goes to the ERC rather than the PPP.

- The article goes on to discuss some potential implementation and law drafting issues. There is also a Part 2 of the article available.

The Final Rules and Regulations have not been issued. These are our interpretations based on assumptions. Based on the CARES Act of March 2020 it is very likely the IRS will not only issue Rules and Regulations but will also issue FAQ’s to better understand the Legislation. We will keep you informed as the Government Agencies clarify the details of the legislation.