25 Feb 2020 Education Tax Credits and Deductions for 2019

View this article in PDF format.

Education Tax Benefits

If you pay tuition, fees, and other costs for attendance at an eligible educational institution for yourself, your spouse, or your dependent, you may be able to take advantage of one or more of the education tax benefits. You can claim more than one education benefit in a tax year as long as you do not use the same expenses for more than one benefit.

Exception: Qualified expenses used to claim education benefits can also be used to eliminate the 10% penalty on premature IRA distributions. For each student, you can elect for any year only one of the credits. For example, if you elect to claim the American Opportunity Credit for the student in 2019, you cannot use that same student’s qualified education expenses to figure the Lifetime Learning Credit for 2019.

Education Deductions

Deductions reduce the amount of income subject to income tax. Deductions for education expenses include:

- Student loan interest deduction up to $2,500 from gross income. Income limitations apply.

- Business deduction on Schedule C or F. You can deduct the cost of education related to the business or farm activity.

- Qualified taxpayers are allowed an above-the-line deduction for qualified higher education expenses paid by the taxpayer during a taxable year. Taxpayers with AGI not exceeding $65,000 ($130,000 in the case of married taxpayers filing joint returns) are entitled to a maximum higher education tax deduction of $4,000 and taxpayers with AGIs that don’t exceed $80,000 ($160,000 in the case of married taxpayers filing joint returns) are entitled to a maximum deduction of $2,000. Taxpayers with AGI above these thresholds are not entitled to the tuition deduction. This deduction is not allowed if the American Opportunity Tax Credit produces a lower tax.

Education Tax Credits

Tax credits reduce the amount of income tax you may have to pay. Income limitations apply. The education credits are claimed on Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits).

- American Opportunity Credit, $2,500 maximum per student per year.

- Lifetime Learning Credit, $2,000 maximum per tax return per year.

Income Limits

The American Opportunity Credit is phased out at modified AGI between $80,000 and $90,000 ($160,000 and $180,000 MFJ) in 2019.

The Lifetime Learning Credit is phased out at modified AGI between $58,000 and $68,000 ($116,000 and $136,000 MFJ) in 2019.

Penalty-Free IRA Distributions

If you withdraw money from your IRA before you are age 59½, you are generally subject to a penalty of 10% of the distribution, in addition to any tax that may be due on the distribution.

- The 10% penalty does not apply to traditional IRA or Roth IRA withdrawals, if you use the money to pay qualified education expenses for yourself, spouse, or for any child or grandchild of yourself or your spouse.

- Qualified education expenses include tuition, fees, books, supplies, equipment, and special needs services required for enrollment or attendance at an eligible educational institution. Room and board for students enrolled at least half-time in a degree or certificate program may also qualify.

- Reduce qualified expenses by scholarships and other tax-free assistance the student receives, but not by gifts or inheritances.

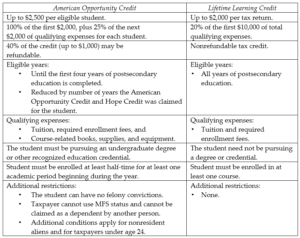

Comparison of Education Credits

Click image to view:

Education Savings Plans

Contributions that you make to education savings plans are not deductible, but the earnings accumulate tax free. In addition, no tax will be owed on distributions if they are less than the beneficiary’s qualified education expenses. Qualified expenses are reduced by scholarships, other tax-free assistance, and amounts used to figure education credits.

- Qualified Tuition Programs (QTPs). QTPs are also called 529 Plans because they are authorized under section 529 of the Internal Revenue Code.States sponsor QTPs to allow prepayment of a student’s qualified higher education expenses. For information on a specific QTP, you need to contact the state agency or eligible educational institution that established and maintains it. Effective January 1, 2018, 529 Plans may distribute not more than $10,000 in expenses for tuition during the taxable year for a public, private, or religious elementary or secondary school. Distributions in excess of $10,000 are subject to tax. This limitation applies on a per-student basis, rather than a per account basis.

- Coverdell Education Savings Accounts (ESAs). A Coverdell ESA can be used to pay a student’s eligible K-12 expenses, as well as higher education expenses. Coverdell ESA contributions are limited to $2,000 total per year for each beneficiary, no matter how many accounts have been established or how many people are contributing. Unless the beneficiary is a person with special needs, contributions to a Coverdell ESA must stop before the beneficiary reaches age 18 and the account balance must be distributed within 30 days after the beneficiary reaches age 30 (or dies, if earlier).

Exclusions from Gross Income

An exclusion from income means you don’t report the benefit you receive as income and you don’t pay tax on it, but you also can’t use that same tax-free benefit for a deduction or credit.

- You may exclude the part of scholarships, fellowships, and grants that you use for qualifying education expenses while you are a degree candidate.

- You may exclude up to $5,250 paid for you under a qualifying educational assistance plan. Additional amounts are included in your W-2 income, unless they are a working condition fringe benefit. A working condition fringe benefit is an amount that you could have deducted as an employee business expense, had you paid for it instead of your employer.

- If you cash in qualified U.S. Savings Bonds to pay for eligible education expenses for yourself, spouse, or your dependent, you may exclude the bond interest from income. Income limitations apply.

Contact Us

There are many events that occur during the year that can affect your tax situation. However, negative tax effects can be avoided by proper planning. Please contact us in advance if you experience any of the following:

- Pension or IRA distributions.

- Sale or purchase of a residence or other real estate.

- Significant change in income or deductions.

- Retirement.

- Job change.

- Notice from IRS or other revenue department.

- Marriage.

- Divorce or separation.

- Attainment of age 59 ½ or 70 ½.

- Self-employment.

- Sale or purchase of a business.

- Charitable contributions of property in excess of $5,000

This page contains general information for taxpayers and should not be relied upon as the only source of authority. Taxpayers should seek professional tax advice for more information.