01 May 2019 Bonus Depreciation

On December 22, 2017, the President signed into law new tax legislation that lowered some tax rates and eliminated or changed numerous tax provisions. This article will focus on some of the major changes related to Bonus Depreciation. If you have questions please contact us.

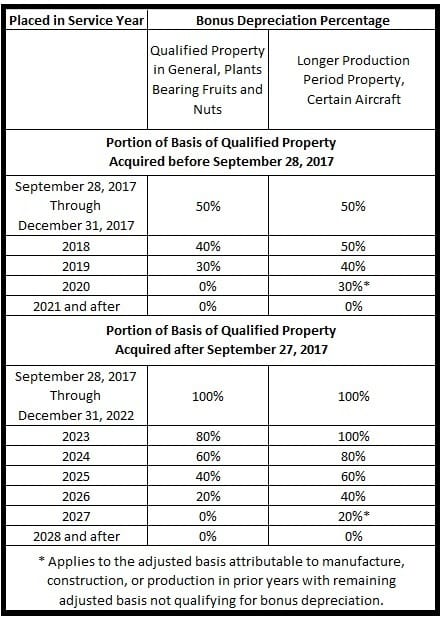

The prior law phase-down of bonus depreciation still applies for property acquired before September 28, 2017 but placed in service after September 27, 2017. The new law increases the bonus depreciation to 100% for property acquired (and placed in service) after September 27, 2017, with a new phase-down schedule for years after 2022. For a taxpayer’s first tax year ending after September 27, 2017 (the 2017 tax year for calendar year taxpayers), a taxpayer can elect to apply the 50% allowance instead of the 100% allowance.

The chart below provides the new percentages and phasedown amounts for each year:

New and used property.

The new law removes the requirement that the original use of qualified property must commence with the taxpayer. Thus, bonus depreciation is allowed for both new and used property.

Automobile Section 280F limits for bonus depreciation.

The new law maintains the IRC section 280F increase amount of $8,000 for passenger automobiles placed in service after December 31, 2017. Thus, the phase-down under prior law for autos placed in service after 2017 no longer applies. The prior law phase-down still applies to automobiles acquired before September 28, 2017 and placed in service after September 27, 2017.

Regulated public utilities.

The new law removes water utility property from bonus depreciation if rates are regulated by a governmental body.

Update

There apparently is a glitch in the new law concerning qualified improvement property.

Qualified improvement property is defined as any improvement to an interior portion of a building which is nonresidential real property if such improvement is placed in service after the date such building was first placed in service. Such term does not include any improvement for which the expenditure is attributable to the enlargement of the building, any elevator or escalator, or the internal structural framework of the building.

For the new law, qualified improvement property placed in service after December 31, 2017 was supposed to be depreciable over 15-years (under MACRS) using the straight-line method and half-year convention, without regard to whether the improvements are property subject to a lease, placed in service more than three years after the date the building was first placed in service, or made to a restaurant building. The problem is the actual Internal Revenue Code section for qualified improvement property makes no reference to the 15-year class life. As a result, qualified improvement property by default is nonresidential real property subject to 39-year straight-line depreciation.

The Conference Committee report clearly shows that Congress intended qualified improvement property to have a 15-year class life, but the Conference Committee report cannot overrule the clear language of the statute.

Without a technical correction, effective for 2018, qualified improvement property is subject to 39-year straight-line depreciation, does not qualify for bonus depreciation, and does not qualify for Section 179 expensing, because bonus depreciation and Section 179 are allowed only for property having a class life of 20 years or less.

The tax information provided above is general in nature and there may be differences in your specific situation. We are here to assist you in evaluating what deductions you may be eligible for and which course of action can be taken to minimize your income taxes. Contact us today!

Click Here to view this article in PDF format.

This page contains general information for taxpayers and should not be relied upon as the only source of authority. Taxpayers should seek professional tax advice for more information. Copyright © 2019 Tax Materials, Inc. All Rights Reserved