10 May 2022 Why excess labor demand is unhealthy

Authored by RSM US LLP, May 10, 2022

The labor market’s rebound from the pandemic has been nothing short of remarkable. Most of the staggering number of job losses have been recovered, and the unemployment rate is near its pre-pandemic low.

But sometimes in economics there can be too much of a good thing. In this case, it’s the demand for workers, or, to put it more accurately, an excess demand for workers.

The economy is fewer than 1 million jobs from reaching its pre-pandemic level, yet there were a record 11.55 million job vacancies reported in March.

The economy is fewer than 1 million jobs from reaching its pre-pandemic level, yet there were a record 11.55 million job vacancies—a proxy for labor demand—reported in March, according to government data.

That’s because as strong as the economy has been, companies today are facing a harsh reality: The rapid growth of the past year won’t come back anytime soon. Yet many companies are planning to hire workers as if such growth is sustainable.

Although there are signs that companies are adjusting, especially as equity markets retreat, many companies have yet to get the message. And the scramble by companies to find workers—or simply to keep the ones they have—is leading to higher wages, which, in turn, leads to higher inflation.

The result is the stunning number of job vacancies as workers continue to quit their jobs at historically high rates.

The squeeze is made worse as workers who have been on the sideline since the start of the pandemic have been slow to come back to the labor force.

In a sense, it’s a virtuous circle gone wrong as labor demand spirals out of control. It is no surprise, then, that Federal Reserve Chairman Jerome Powell has said that the labor market is “tight to an unhealthy level”—not the words a Fed chairman usually utters in a strong economy.

It is a clear forward guidance for the market to start reacting as the Fed moves to put an end to an era of near-zero interest rates.

We believe this imbalance should prompt companies to reassess their growth potential, and as a result, their demand for labor.

Such a reassessment, in fact, might work in the Fed’s favor as a major decline in labor demand might take place before interest rates are brought back to neutral, potentially in the second half of the year or early next year. The decline will most likely be a sharp one, but it is inevitable and will be necessary.

An unrealistic level of labor demand

Behind the surging labor market is an overheating economy. Elevated spending and economic growth rates last year contributed to a significant increase in corporate profits, rising by 20.97% in the fourth quarter on an annualized basis. That bullish sentiment spilled over to outsized gains in the equity markets.

So, companies reason, why not keep a good thing going? The expectation for further growth, especially when order backlogs remained historically high because of global supply chain issues, pushed labor demand to outpace personal spending and even overall gross domestic product last year, and then continued in the first quarter.

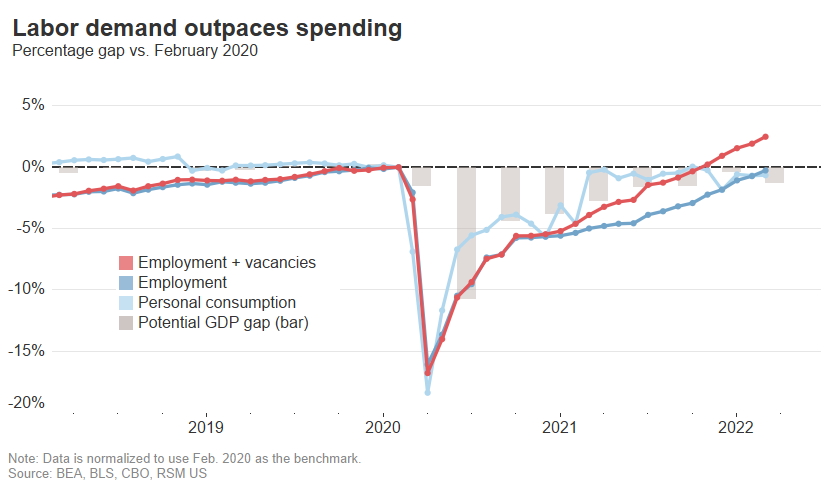

We normalize the levels of employment and employment plus vacancies by using the pre-pandemic level in February 2020 as a benchmark. For gross domestic product and personal spending, while using the same benchmark, we further normalize the two series such that the pre-pandemic upward trend for personal spending and potential GDP, calculated by the Congressional Budget Office, are also controlled for.

What has become clear is that even as the level of employment has nearly reached what many consider full employment with the unemployment rate at 3.5%, total labor demand—employment plus vacancies—continues to surge. In March, it was 2% higher than in February 2020, or 4.1 million in extra demand.

Yet the underlying economic foundation—shown by the level of personal consumption and gross domestic product, which are both near the pre-pandemic trend—shows no support for such a high level of labor demand.

As spending approaches its potential level at full employment, growth is expected to slow down to the long-term rate of 1.8%.

But because companies misjudge growth potential, they continue to make more hiring plans to meet what they see as much larger demand down the road than it turns out to be.

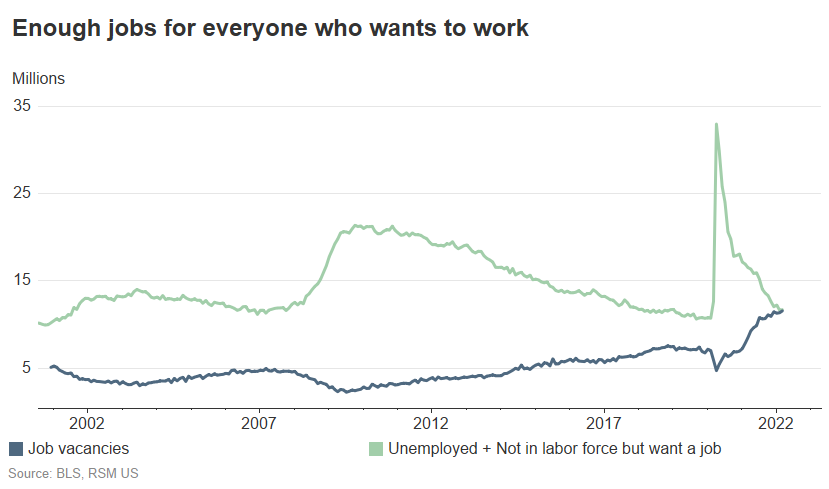

Never before have we seen such a small gap between job vacancies and potential labor supply, which includes unemployed workers who are in the labor force and workers who are not in the labor force but still want a job.

There were 11.55 million job vacancies in March, while the number of unemployed workers was 5.95 million. The number of the not-in-the-labor-force workers who want a job was 5.7 million. The combined number for labor supply was 11.65 million.

That means theoretically, even if everyone who left the labor force because of COVID-19 came back, there would still be enough jobs for everyone but only 100,000 of the total number of workers who want a job.

That scenario would never happen; not all vacancies can be filled with an unemployed worker because of mismatches in skills or preferences. But it still shows just how improbable labor demand has been, because there are simply not enough workers.

Early evidence from companies like Amazon, Netflix, Meta (previously known as Facebook), Peloton and Snapchat—which have seen their stock prices drop as much as 35% because of significant declines in demand—points to the disconnect between where the economy is heading and what businesses had expected. Meta, for example recently announced it would curtail hiring because of stagnant growth. Uber also said it would reduce hiring because of what it called a “seismic shift” in market conditions.

That said, the flaws in growth expectations are quite difficult to avoid during the current volatile and uncertain period that even the Fed has been struggling to deal with. Moreover, unforeseen economic shocks like the recent COVID-19 wave and the Russia-Ukraine war also contribute to the complexity of predicting demand and growth.

The takeaway

Most of the labor shortage issues can be traced to workers who left the labor force because of the pandemic and were slow to return. But with employment getting closer to the pre-pandemic level, outsized labor demand is becoming the main cause for labor shortages.

The Federal Reserve’s move to increase its policy rate by 50 basis points in May, the largest one-time increase since 2000, will certainly help to drive down growth expectations and as a result dampen labor demand.

We believe it is now crucial to turn the focus toward private companies’ shift in labor demand to better assess how the tight labor market will unwind.

DO YOU HAVE QUESTIONS OR WANT TO TALK?

Fill out the form below and we’ll contact you to discuss your specific situation.

This article was written by Tuan Nguyen and originally appeared on 2022-05-10.

2022 RSM US LLP. All rights reserved.

https://realeconomy.rsmus.com/why-excess-labor-demand-is-unhealthy/

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Haynie & Company is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.